Issue 1 | April 27 2020

The Pulse of the Aftermarket

A White Paper Series by Aftermarket Analytics and Full Throttle Technologies

Written by – Justin Holman PhD, CEO of Aftermarket Analytics

Introduction

The purpose of this white paper is to communicate (1) a new partnership and (2) a new set of data analysis capabilities available to suppliers, distributors and retailers in the automotive aftermarket. The new partnership is a collaboration between Full Throttle Technologies and Aftermarket Analytics. Full Throttle Technologies is a provider of automotive repair order (RO) data and Aftermarket Analytics is a provider of analytical software solutions for demand forecasting and inventory management. Combined, the two companies bring together an extensive network of RO data and cutting edge analytics enabling aftermarket professionals to use RO data to drive inventory decisions and supply chain efficiency.

Data Analytics

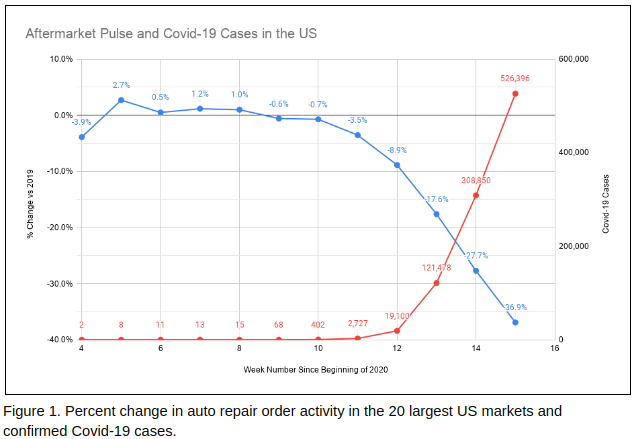

Together, our companies provide a unique solution and an opportunity to better understand market level auto repair shop activity. The Full Throttle Technologies team has queried their massive database to provide RO activity by market for the top 20 largest metropolitan markets in the United States for 2019 and YTD 2020. The Aftermarket Analytics team has analyzed these data to provide a market-by-market snapshot of how the Covid-19 crisis has impacted automotive repair activity. The results, as expected, are fairly startling in terms of the extent to which RO activity has dropped while Covid-19 has spread (see Figure 1).

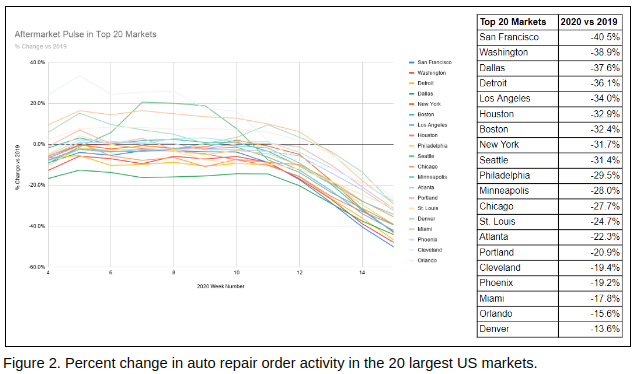

Looking at a market-by-market breakdown the variability in RO activity between markets is fairly pronounced. San Francisco tops the chart in terms of RO activity decline vs 2020 with Washington DC, Dallas and Detroit close behind; whereas Denver, Orlando, Miami, Phoenix and Cleveland have taken a hit but have, thus far, seen smaller declines vs 2019 (See Figure 2).

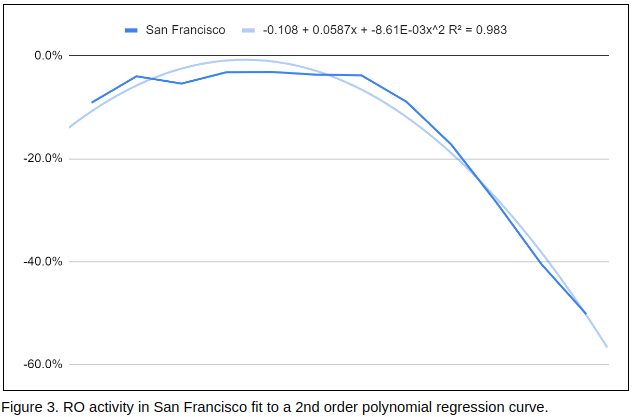

You may also be wondering about whether we could use these data to predict future demand levels. In particular you may be wondering if we can forecast where and when demand will return. Yes, we think this is a strong possibility. To illustrate, in the graph below we show the sharp decline in RO activity in San Francisco and we’ve fit a polynomial to track the downward trajectory (See Figure 3).

We think an approach similar to this, in combination with Covid-19 case and mortality data, will help us predict rates of recovery as the economy begins to reopen in the coming weeks and months. And, if we have a second wave of Covid-19 cases as many experts predict we hope to forecast these declines as well. We won’t be able to remove all uncertainty but we believe we can help your company position inventory to most efficiently recapture market share as the market returns to the new normal.

Conclusion

In these unprecedented times of pandemic and economic upheaval, it’s never been more important to be able to take the pulse of the aftermarket, not just nationally or regionally but also at the market level, to predict aftermarket activity and put your company in the best position to provide the right part in the right place at the right time.

If you have questions about this white paper or if you would like to learn how these data could be utilized to help your business, please use the contact information below to reach out to us.

For more information, please contact us:

Shawn Wills, Dir. National Accounts, Email: [email protected] Cell: 303-956-2848

Richard Bernstein, VP Business Development, Email: [email protected] Cell: 847-707-8450