Issue 15 | February 2 2021

The Pulse of the Aftermarket

A White Paper Series by Aftermarket Analytics and Full Throttle Technologies

Written by – Justin Holman PhD, CEO of Aftermarket Analytics

National Pulse

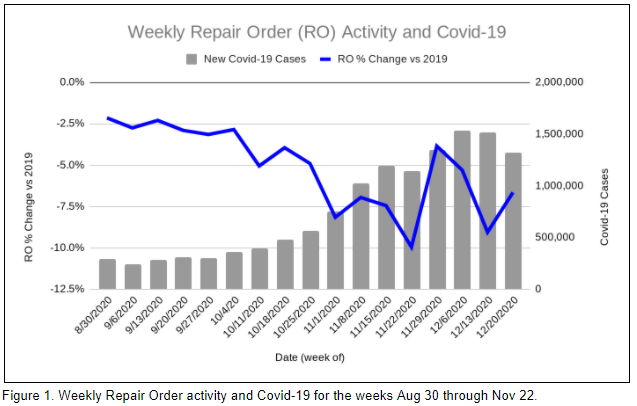

Weekly Repair Order (RO) activity reversed the downward trend that had begun in late September and finished the year on a modest upswing. In the last week of November RO was down 10% but it bounced back sharply into the second week of December before falling back into the negative high single digits during the last two full weeks of the year.

National Forecast

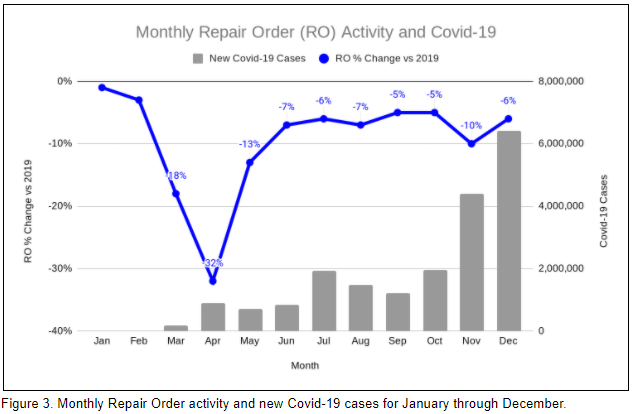

Our forecast in December called for RO activity to flatten, but remain down 10-12%. This turned out to be somewhat pessimistic. RO activity actually finished the year down only -6%. For 2021 we may need to rethink our data analysis approach to either continue year over year comparisons or to adopt a new metric for tracking RO activity. Please let us know what you think would be most helpful.

Full Year (YTD)

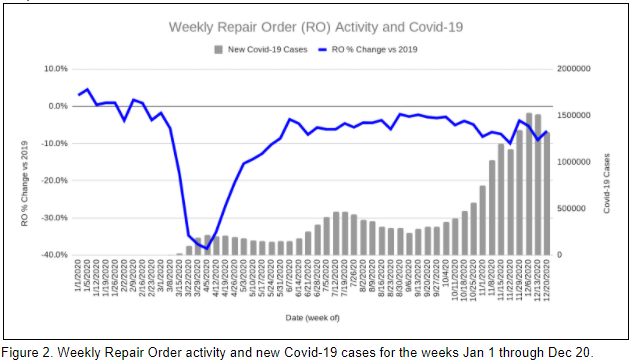

Graphics illustrating RO activity for the full year of 2020, on both a weekly and a monthly basis, are provided below.

Market Pulse

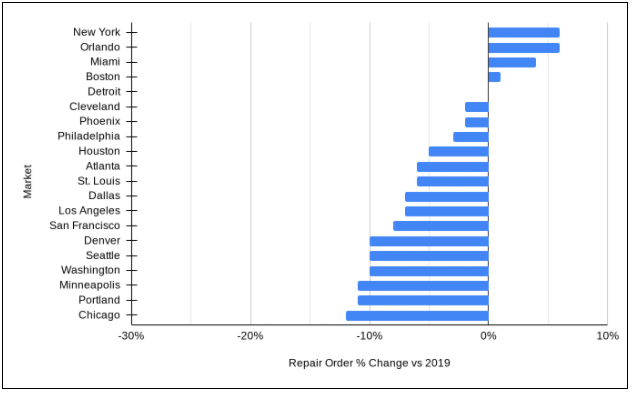

A few markets were up versus 2019 with New York and Boston joining Orlando and Miami in positive territory. Most markets remained in negative territory but there was broad partial recovery during the last month of the year. Chicago was down the most at -12%.

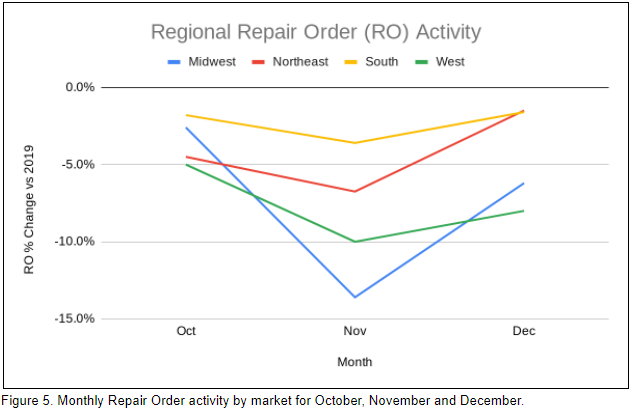

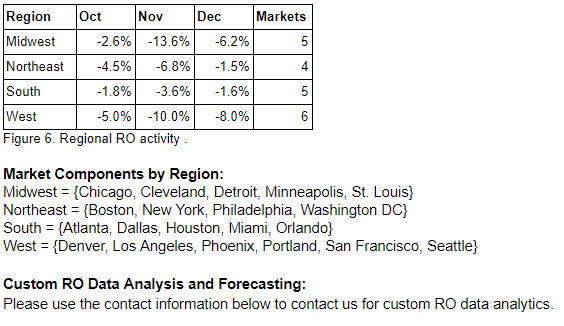

Regional Pulse

Aggregating markets into four regions gives us a cleaner illustration of the geographical distribution of RO activity. The Midwest has been hit harder than the other regions.

For more information, please contact us:

Shawn Wills, Dir. National Accounts, Email: [email protected] Cell: 303-956-2848

Richard Bernstein, VP Business Development, Email: [email protected] Cell: 847-707-8450