Issue 14 | December 22 2020

The Pulse of the Aftermarket

A White Paper Series by Aftermarket Analytics and Full Throttle Technologies

Written by – Justin Holman PhD, CEO of Aftermarket Analytics

National Pulse

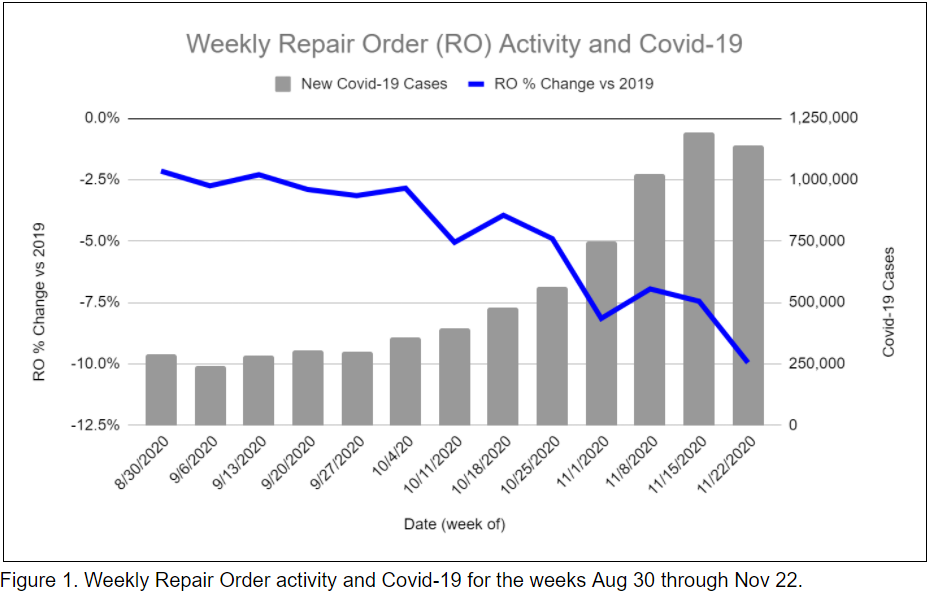

Weekly Repair Order (RO) activity began a gradual decline in late September. The decline in RO appears to have begun concurrently with the onset of the most recent surge in Covid-19 infections. RO had recovered almost completely by early September when it was down only 2-3% versus 2019. In the last week of November RO was down 10% and appears to be trending lower. Certainly there are other impactful variables to consider, mostly economic and perhaps also political given the timing of the 2020 election. Hopefully the approval and distribution of vaccines from Pfizer and Moderna in December will help reverse the trend. Congressional approval of another stimulus package may also contribute.

National Forecast

For December we’re forecasting RO activity will flatten, still down 10-12% but not falling as sharply as it did during the months of October and November.

Full Year (YTD)

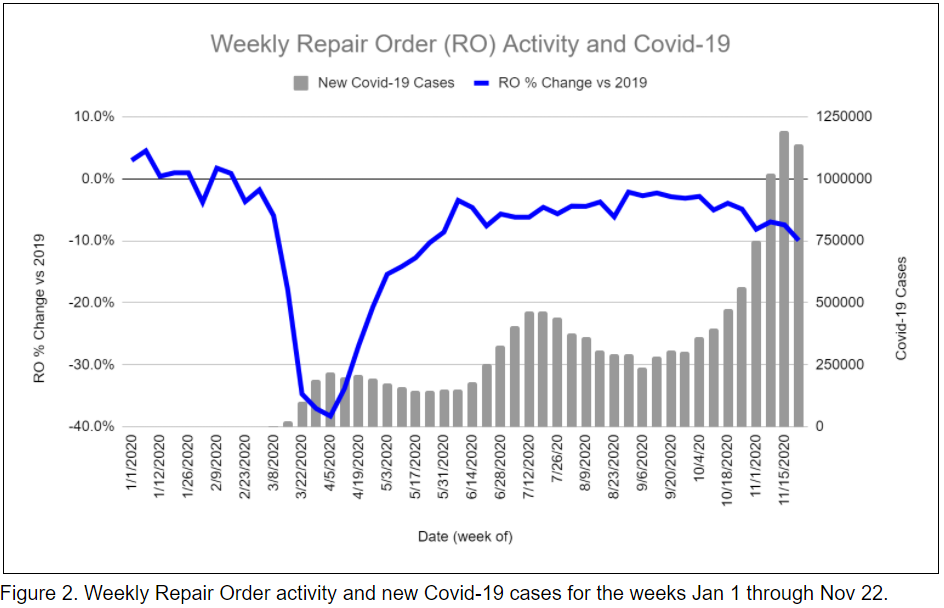

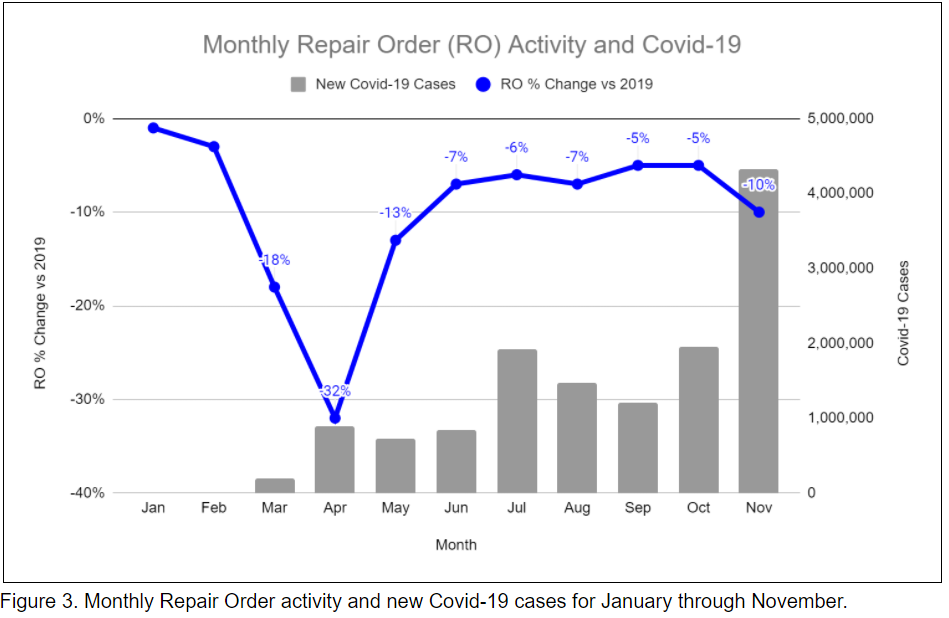

Graphics illustrating RO activity for the full year to date, on both a weekly and a monthly basis, are provided on page 2 of this issue (See Figures 2 and 3).

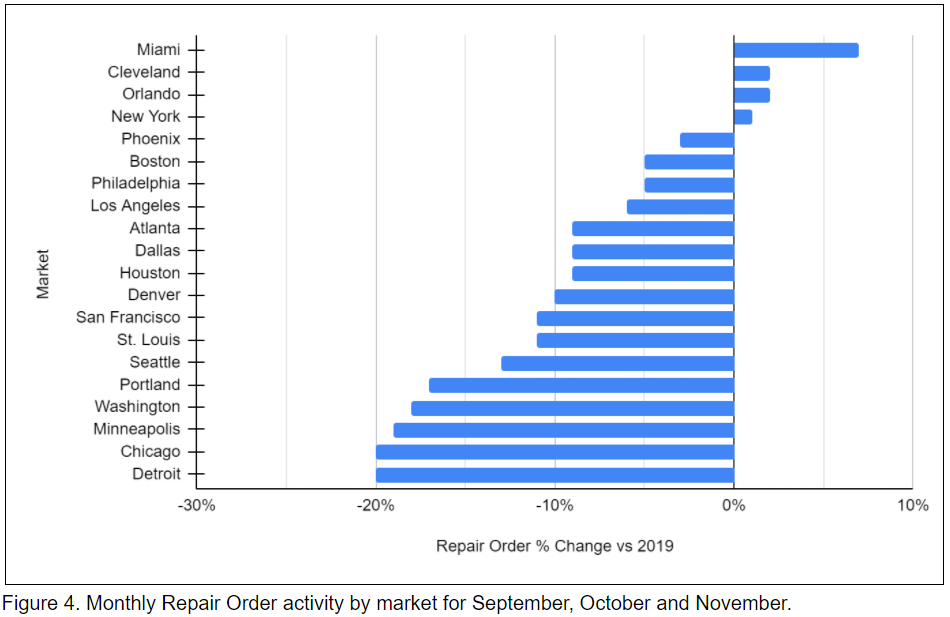

Market Pulse

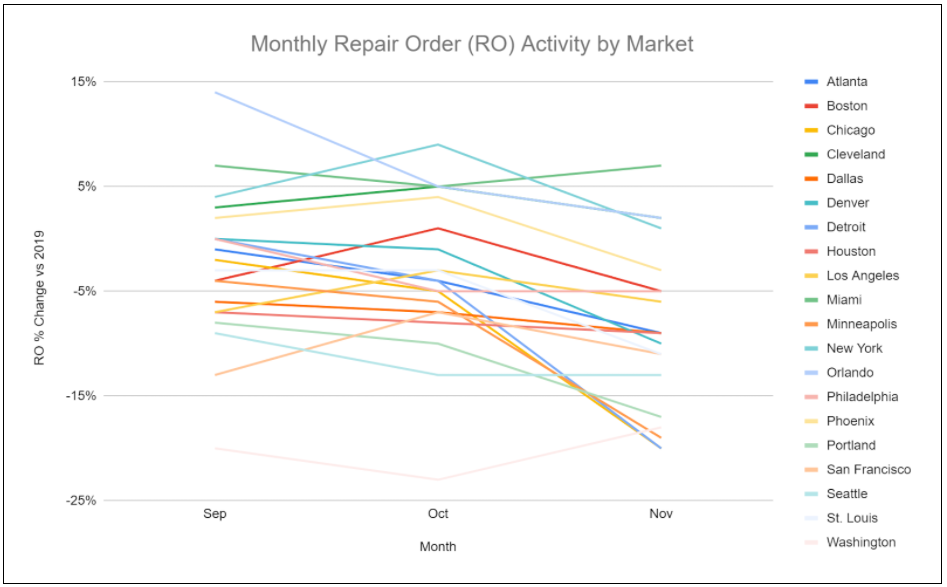

A few markets were up versus 2019 with Miami leading the way (+7%) while most markets remained in negative territory, ranging from -3% (PHX) to -20% (CHI and DET).

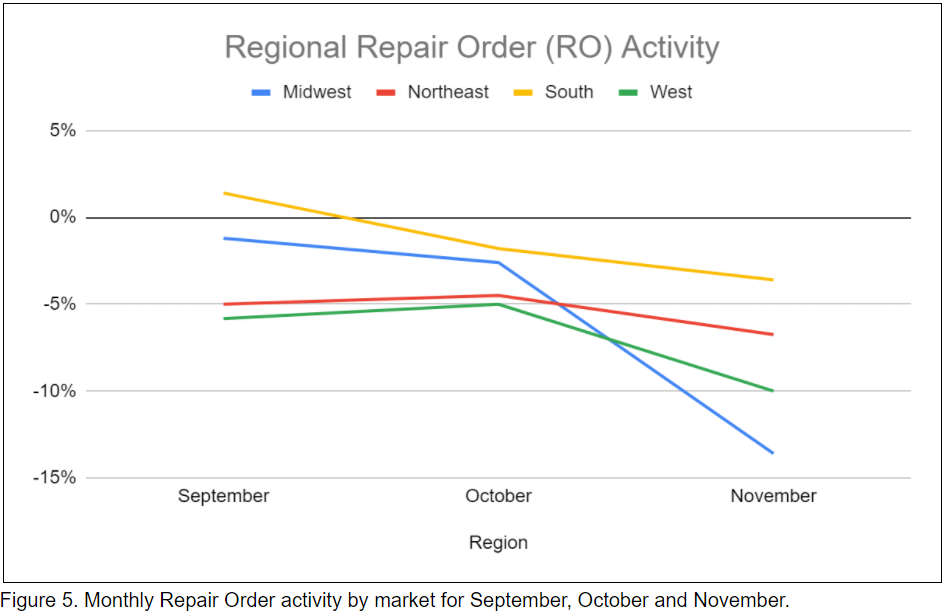

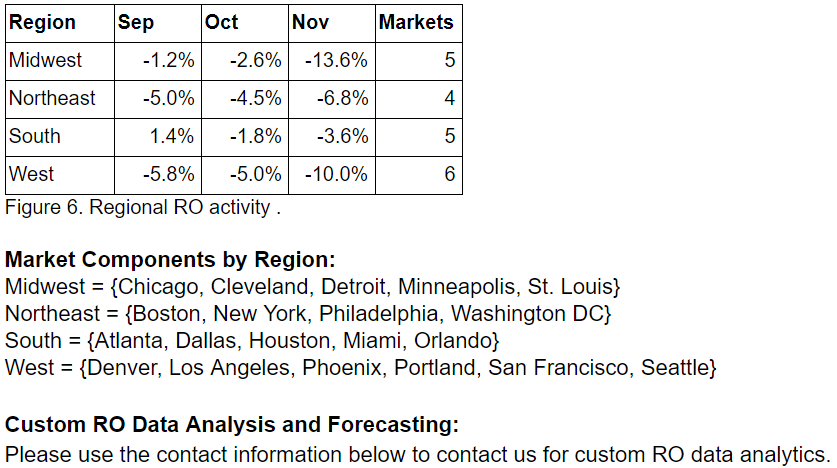

Regional Pulse

Aggregating markets into four regions gives us a cleaner illustration of the geographical distribution of RO activity. The Midwest has been hit harder than the other regions.

For more information, please contact us:

Shawn Wills, Dir. National Accounts, Email: [email protected] Cell: 303-956-2848

Richard Bernstein, VP Business Development, Email: [email protected] Cell: 847-707-8450